KABUL (Pajhwok): To prevent illegal financial transactions, Da Afghanistan Bank (DAB) or central bank has introduced a new policy, but money changers want the policy to be reviewed and analysts consider it necessary to legalize the money markets.

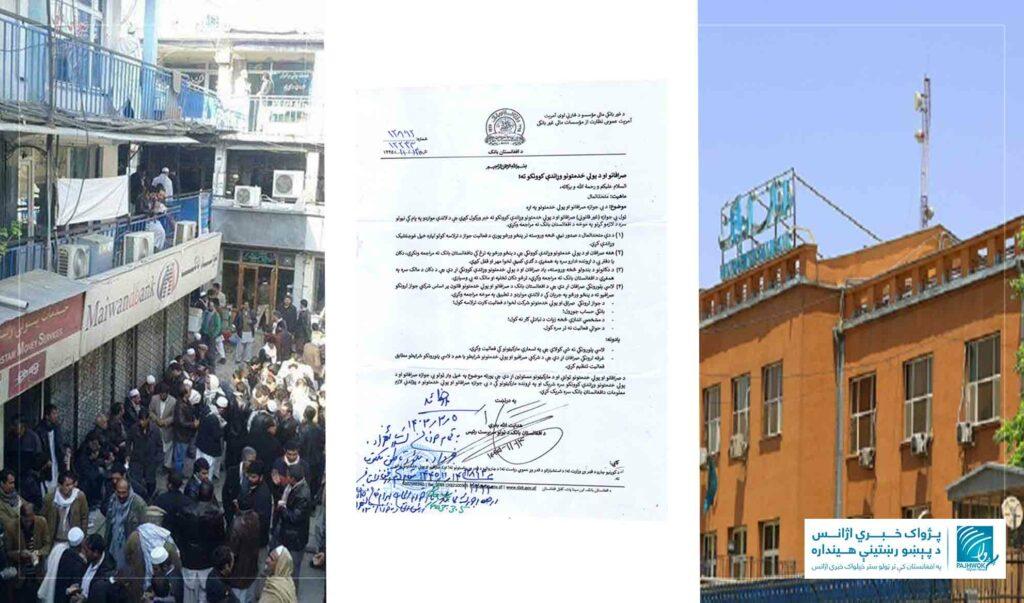

DAB through a letter about fortnight ago informed all unlicensed (illegal) money changers and money service providers to apply for license within five days, otherwise their shops or offices will be sealed by the joint committee in coordination with relevant authorities.

The letter asked small money changers to obtain activity card from licensed money changers and money services companies within five days, their exchanges should not exceed more than 200,000 afghanis and should avoid hawala deals.

The letter says peddlers are not allowed to operate in currency markets and money changers should organize their activities as per the rules of company exchange and money services or the rules for peddlers.

As per the letter, a new license seeker must have a capital of 100 million afghanis in Kabul, 80 million afghanis in the centers of the remaining zones and 50 million afghanis in other provinces.

Guarantee

The letter says: “In the centers of the zones (Kabul, Herat, Kandahar, Balkh, Kunduz, Nangarhar and Paktia), 10 million afghanis and n other provinces five million afghanis and a company guarantee from a valid licensee is required and If the shareholders of the company fail to provide a valid guarantee, a cash guarantee of 20 million afghanis will be taken from the company license applicant in the centers of the zones and 10 million afghanis in other provinces”.

Conditions for opening money exchange business

A two million afghanis guarantee should be submitted to DAB for opening a money exchange branch in Kabul, Balkh, Kunduz, Kandahar, Nangarhar, Herat, Ghazni, Helmand, Nimroz and Khost provinces.

The DAB letter states: “10 million afghanis should be submitted to DAB for each branch in Kabul, Balkh, Kunduz, Kandahar, Nangarhar, Herat, Ghazni, Helmand, Nimroz and Khost and five million afghanis in other provinces with necessary documents.”

Pajhwok tried to know the previous license price, but DAB and money changers did not provide information about it.

Some money changers contradict this decision

Abdul Rahman Zeerak, spokesperson of the Sarae Shahzada Money Changes and Cash Services Union, told Pajhwok Afghan News that this letter was received by money changers nationwide and DAB started its implementation through a delegation made of different government institutions.

He said they urged DAB to review this decision and guideline because all money changers were unable to implement it.

Most of the money changers who could not implement this order had no option but to stop their business, therefore, they urged the DAB to review its decisions.

He demanded the postponement of this decision until Eid because most people from foreign countries send money to their relatives, according to Zeerak remittances played a vital role in maintaining the value of afghani.

Haji Qandi Agha, head of the Kandahar Money Changers Union, said in the past in bank guarantee for a money changer license was three million afs and capital 10 million afs but in the new guideline huge amount has been set which could not be affordable to many money changers.

He said: “No one is against the new money changers license, but our request is that these licenses should be divided into two or three parts; because now very few people can fulfill the set guarantee and capital amount, all other money changers will stop this business, so we say that separate individual licenses should be given to small money changers and hand sellers by the DAB, the guarantees and capital should low because their assets are low as well.”

He said 600 money changers works in Kandahar, each hired up to five people and thousands of others benefited from this business.

But Haseebullah Noori, head of DAB, said the decision was taken to prevent illegal money changers or those working illegally.

People have often suffered due to illegal deals and with the implementation of this policy all deals would be carried out according to the principles transparent and fairly, he said.

“Illegal activities, lack of transparency in deals, the violation of international standards, beyond the need business which paved the way for unhealthy competition and some other reasons it was considered that this policy should be chalked out and implemented to put the money changing business in proper mechanism,” said Noori.

He said individuals who could not get their own licenses could run their business under the license of another company.

He said at the movement 1,000 money changer companies and over 5,000 sub-companies provided cash services to the people in the country.

Providing guarantee is important

Qais Mohammadi, an economic affairs expert, told Pajhwok Afghan News: “When a company could not provide a 10 million afs guarantee how did it give itself the right to deal with 100 million of public money, if a problem occurred in this regard who would answer, getting such guarantee is a common practice nationwide.”

He said in other countries interest of the guarantee amount returns to the money changer companies but there is no interest in Afghanistan so DAB could work on this amount and share the profit with the money changer companies.

Mohammadi said Money markets in Afghanistan have not yet been legalized and the laws that are implemented in other countries to monitor and control money have not been implemented because most of the banks of Afghanistan are included in black or gray lists with the rest of the world,

He said Afghanistan needed to implement laws practiced in other countries if it wanted to connect with the world cash market.

He said the Hawala system, financial market system, money auction, sale, purchase and transfer are all parts of the cash market which required strong monitoring.

If these things are not monitored, it would lead to the transfer of money from Afghanistan to different elements without knowing whether this money was used to finance terrorism, used for drugs or any other purpose.

To find out from which source money is transferred to which source from Afghanistan it was necessary to collect complete information about this and the legality of financial markets is an essential part in this regard.

Nh/nh

Views: 140

GET IN TOUCH

NEWSLETTER

SUGGEST A STORY

PAJHWOK MOBILE APP