By: Mahboob Shah Mahboob

Research Scholar

Faculty of Management,

Vivakananda Global University, Jaipur

++++++++++++++++++++++++

Abstract

Microfinance is a game-changer for women’s economic and social empowerment and has changed how the poor are seen in a lot of countries. Many nations’ central banks have recently opened their doors to low-income families and communities, allowing them access to financing that was previously unavailable to them. Before this study, researchers from several nations came to the conclusion that women who participated in MFIs were more empowered in many ways, including: economic, social, and political awareness; mobility; organisational skills development; knowledge; self-confidence; and economic, social, and political em

Mahboob Shah Mahboob

powerment. The most pressing and divisive problem facing the world now is, without a doubt, the empowerment of women. There can be no exceptions when it comes to Afghanistan’s participation in women’s empowerment. The Afghan government and donor communities came to an agreement to launch a microfinance programme to support micro-enterprises under the Ministry of Rural Rehabilitation and Development, in response to the urgent need for income-generating livelihoods for the people.

Keywords: Microfinance Services, Afghanistan, Empowerment, Socio-Economic, Afghan Communities, Income Generation.

*Corresponding Author

- INTRODUCTION

People, especially women, who do not have access to traditional banking services can benefit from microfinance as a means of economic empowerment. It has developed to provide dependable and inexpensive loans (Aden Hassen, 2020) that do not require collateral. Microfinance effect assessments have always focused on economic indicators, with assessors eager to measure income changes despite the enormous difficulties this presents. Levels and patterns of consumption, assets, and expenditure are other common variables. There is a strong belief that low-income households may significantly reduce poverty and bring about significant changes to social (Ali S. &., 2018)and economic institutions if they are provided with financial services.

People with low incomes or no jobs can use a variety of banking services, including microfinance, which helps with both financial and non-financial matters. There has been a long history of the microfinance concept’s development. (Ashraf D. R., 2022)Dr. Muhammad Yunus, a Nobel laureate, established the Grameen Bank, which contributed to its widespread renown. Professor Yunus made it famous by loaning empowering women in Bangladesh money and seeing if they could pay it back. Without a question, the push by MFIs has changed the way the poor in many nations see themselves. Large credit flows have been established by certain nations, especially for the low-income population that is traditionally not allowed access to traditional forms of funding. For a long time, small borrowers all around the world have been able to access traditional microfinance. Nonetheless, contemporary microfinance emerged in the contemporary era. Microfinance (Balliester Reis T. , 2022) has grown in prominence as a means to alleviate poverty and provide agency to the marginalised. When it comes to achieving economic and social empowerment, microfinance is crucial.

Being able to break free from the constraints of poverty and social or religious norms is a key component of women’s empowerment, according to. Research has shown that microfinance has a favourable effect on women’s empowerment. Additionally, numerous studies demonstrated that women’s participation in MFIs boosted their empowerment through the acquisition of more information, self-assurance, economic, social, and political awareness, mobility, and organisational abilities. Additionally, (Dhungana B. R., 2018) formal economic activity was little, and the banking sector was hardly active, when the war ended in Afghanistan. To satisfy its liquidity demands, the nation depended on the informal loan market and the traditional (Hawala) money transfer system, as there were no operating commercial banks. The financial sectors in Afghanistan underwent a substantial transformation following the fall of the Taliban authority in late 2001 and the establishment of a government chosen by representative ballot. The government established new (Iitondoka, 2018) laws for the financial sector in 2002 with the goals of developing a commercial banking sector and enhancing the monetary management and banking supervision activities of Da Afghanistan Bank (DAB). To empower low-income people in rural and urban areas, microfinance organisations provide small-scale loans, savings accounts, and other financial goods and services. (Dhungana B. R., 2022) This helps these people make ends meet and improves their living conditions.

- Background of the study

Afghanistan, a country whose history is tainted by wars, political unrest, and catastrophic natural events, provides the backdrop for this study. (Bandara, 2023) Since most people live and work in rural areas, they are more vulnerable to the effects of long-term instability. Economic progress and the maintenance of poverty are both impeded by the scarcity of conventional financial infrastructure in these areas. (Laha, 2019) One important approach to this problem is microfinance programmes, which help people without access to traditional banking services by giving them small loans, teaching them about money management, and offering other forms of support. The goal of these programmes is to empower underprivileged communities and boost local economies, with a special focus on women and small-scale entrepreneurs. The success of microfinance programmes in Afghanistan is heavily influenced by the country’s specific gender dynamics, cultural norms, and historical context. Microfinance programmes (Moahid M. K., 2021) have the ability to reduce poverty, promote economic resilience, and empower individuals in rural Afghan communities. This study aims to evaluate these impacts and more in light of this context.

- Top of Form

- Objectives of the Study

The purpose of this study is to (Jabeen, 2020) investigate the far-reaching effects of microfinance initiatives in rural Afghanistan. Among the particular goals are:

- To look at how microfinance has helped Afghan entrepreneurs. It looked at the entrepreneurs’ savings and job creation rates, as well as their income levels before and after receiving loans from MFIs and MFB.

- To determine how microfinance has helped rural populations generate revenue.

- When it comes to small-scale businesses, studying how microfinance might help create jobs is crucial.

- The purpose of this study is to analyse how microfinance has helped empower women in rural Afghanistan.

- Significance of the Study

Microfinance programmes face (Rovidad, 2020) a dynamic and difficult environment, and this study aims to shed light on how these programmes perform in such a setting. The project seeks to educate stakeholders, development practitioners, and policymakers with the possibilities and constraints of microfinance in rural Afghanistan by investigating the (Singh, 2022) socio-economic effects at several scales, ranging from individual entrepreneurs to complete communities.

- LITERATURE REVIEW

(Chandrashekhar, 2019) is generally seen as a viable strategy for encouraging female entrepreneurs, especially in less developed economies. Women company owners in Afghanistan often face obstacles such a lack of capital and self-doubt about their managerial and organizational skills. Lack of finance, fear of failure, and social limitations all work against Afghan women entrepreneurs when it comes to organizing and running their firms. Many Afghan women have been inspired to launch micro and small companies because to the work of commercial and state-owned microcredit organizations. This research aims to examine how microfinance has impacted Afghan women business owners. Banks, the Afghan Microfinance Association (AMA), Microfinance (Memon, 2022)Support Investment for Afghanistan (MISFA), and other microfinance institutions’ publications and reports provided the secondary data used in this study. This study’s results demonstrate that microfinance plays a positive role in fostering entrepreneurial growth in Afghanistan. In addition, the data shows that women business owners’ incomes have increased significantly after taking out loans from MFIs.

(Trokic, 2020) Modern society has made examining ways to reduce poverty and promote socioeconomic growth a top priority. Microfinance was founded as a means to address this, and it has since grown in importance as a tool in the fight against poverty. However, research on its efficacy in contexts other than poverty is scant. After administering questionnaires to those who had benefited from both traditional and Islamic microfinance, researchers used the Kruskal-Wallis and Mann-Whitney U tests to assess the collected data. Findings reveal that conventional and Islamic microfinance institutions (MFIs) offer distinct socioeconomic advantages to their borrowers depending on a number of factors. When it comes to helping their clients out financially and socially, traditional and Islamic microfinance institutions follow very much the same playbook. Where they differ, though, is in regard to the gender of the client; IMFIs seem to help women more than men. In terms of service development, this research will be useful for microfinance institutions (MFIs) because it will show them where they stand in relation to their mission to help the poorest of the poor, increase financial inclusion, and contribute to socioeconomic development.

(Moahid, 2020) Affordability of finance is critical to agriculture’s long-term viability. This research employs a Probit model to identify credit constraints and a double hurdle model to examine the factors that influence the amount and involvement of credit in agricultural families. To achieve this goal, we used survey data from 292 Afghan farming households. In the double hurdle model, factors such as crop diversification, education, household size, number of people, land size, and access to extension were found to favorably influence families’ financial actions. Less engagement is likely to occur when income (Ogbe, 2021) is not from agriculture. While small-scale and remote agricultural households did not benefit from official credit, they did turn to informal lending, particularly in times of economic shock, according to the study of credit limitations. The likelihood of avoiding formal credit was higher among religious people, although the likelihood of avoiding informal credit was not. It is proposed that formal credit be extended to rural regions, particularly to households engaged in small-scale farming. Additionally, policymakers ought to think about expanding access to extension services. Households in Afghanistan would be more comfortable utilising formal credit if banks offered loans that were consistent with Sharia law.

(Ullah, 2020) explored how microfinance could help the mountain people of Gilgit-Baltistan, Pakistan’s Central Karakorum National Park region escape mountain-specific poverty and raise their level of living. This study used a multi-stage sampling strategy in 2019 to gather quantitative and qualitative household-level data from 424 families in two districts of the CKNP region in Gilgit-Baltistan. The households were surveyed through structured questionnaires. In order to achieve the goal of sustainable development in mountain areas in the future, the study recommends that policymakers and other stakeholders provide technical and vocational education to the poor mountain inhabitants to increase their productive capacities. They should also expand the reach of the microfinance programme to ensure that financial services are delivered.

(Sethi, 2019) Microfinance has made a significant impact on numerous emerging economies throughout the globe. Therefore, this paper’s goal is to examine and analyse the industry’s performance in six neighbouring South Asian countries: Sri Lanka, Afghanistan, Bangladesh, India, and Pakistan. We have utilised E-views’ Fixed Effects panel data estimations to assess these nations’ performance. There is a notable disparity in performance across all fourteen performance metrics. In order to rank the countries according to the chosen criteria, we have to undertake a lot of laborious computations. In first place is Bangladesh, followed closely by India, and in bottom place is Afghanistan. In order to comprehend and evaluate the causes of the six nations’ dissimilar performance, a theoretical framework has been established.

- RESEARCH METHODOLOGY

This descriptive study draws on secondary data collected from twenty-eight case studies of Afghan entrepreneurs, both men and women, who have benefited from the financial backing of various microfinance institutions. These accounts are based on things you may find on the websites, journals, and reports of MISFA and AMA, as well as other sources that are pertinent to the topic.

The authors utilised the alternative Paired T-Test (Wilcoxon Sing Rank Test) in IBM SPSS 25 version to analyse the influence of microfinance on the income growth of entrepreneurs after they took out loans from MFIs/MFB. This was due to the fact that the retrieved data was not normally distributed.Sample size: The no of the cases is taken is 50

- DATA ANALYSIS AND INTERPRETATION

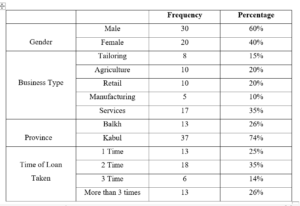

The demographic characteristics of the sample population are presented in Table 1 together with descriptive statistics. Included in the data are a number of important elements, such as the breakdown by gender, the kinds of businesses, the provinces, and the frequency with which loans were taken out during a given time frame.

Table 1: Statistics for Demographic Indicators

Source : AMA Reports

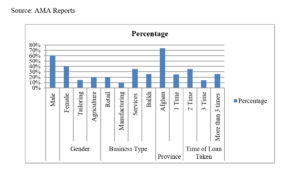

Figure 1: Statistics for Demographic Indicators

Interpretation Sixty percent of the participants are men and forty percent are women. A small male predominance is highlighted by this gender distribution, which provides insight into the sample’s representation of both sexes.

A variety of economic activities were carried out by the respondents, as seen by the split of business kinds. A small percentage of firms are involved in tailoring (15%), while a larger amount are involved in agriculture and retail (20%), manufacturing (10%), and services (35%). This distribution highlights the diverse range of economic situations experienced by the people that were polled.Balkh is represented by 26% of the respondents, with the Afghan province being home to the vast majority (74%). These details provide light on the participants’ regional distribution and reflect the sample’s geographical diversity.Looking at the duration of the loans, we find that 25% of the participants took out a loan once, 35% took out a loan twice, 14% took out a loan three times, and a significant 26% took out a loan more than three times. There may be trends or patterns in the population’s borrowing behaviour that can be inferred from this information about the frequency of taking out loans.

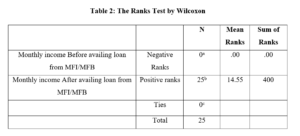

Table 2: The Ranks Test by Wilcoxon

Your monthly income will be less after taking out a loan from an MFI or MFB than it was before you took out the loan.

- Your monthly income after taking out a loan from an MFI or MFB is higher than your monthly income before taking out a loan from an MFI or MFB.

- The monthly income before and after taking out a loan from a microfinance institution or a microfinance bank is equal to one.

Interpretation: Here we can see the difference between the monthly incomes of people who have taken out loans from microfinance institutions (MFIs) and those who have not. A monthly income of.00 with a sum of rankings of.00 is represented by the “Negative Ranks” when applying for a loan. Meanwhile, the “Positive Ranks” add up to 400 and represent the monthly income following loan utilisation; the average rank is 14.55. There are no ties in the dataset, which means that no two ranks are identical. In conclusion, the table shows that monthly income after taking out loans from the MFI/MFB is much larger than income before taking out the loan, as indicated by the positive ranks and higher total of ranks.

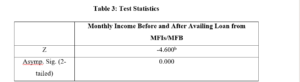

Table 3: Test Statistics

- Wilcoxon Signed Tanks Test Source: MFIs/MFB Reports

- Based on negative Ranks

Interpretation: Microfinance is found to have a positive effect on entrepreneurs’ revenue generation after taking out loans from MFIs/MFBs, as the null hypothesis is rejected and the p-value is 0.000 (cal = 0.000 < 0.05, table value) in the Wilcoxon test.

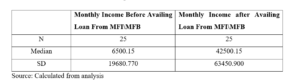

Table 4. Descriptive Statistics of Income Level

Source: Calculated from analysis

Interpretation: Businesses including bakeries, hair salons, carpet weaving, needlework, grocery stores, tailoring, and poultry houses are the main sources of revenue for microfinance consumers. The businesspeople unanimously acknowledged that microfinance had a favourable impact on their revenue. After taking out a loan from an MFI or MFB, the average monthly income of a customer went from 6,500.15 AFN to 42,500.15 AFN.

- RECOMMENDATIONS AND CONCLUSION

Recommendations :

- MFIs should think about offering a wider range of loan products to meet the demands of entrepreneurs in diverse industries. This may involve developing industry-specific financial solutions for industries such as agriculture, manufacturing, retail, and services, with the goal of meeting the unique needs of each firm.

- Business owners can get the ability to manage their finances and take advantage of loans with the help of comprehensive financial literacy programmes. Entrepreneurs should learn how to use microfinance, budget, and plan their businesses effectively through these programmes. This has the potential to help firms grow sustainably and guarantee that entrepreneurs get the most out of their financing.

- Balkh and other underrepresented provinces could be good candidates for microfinance institutions’ outreach initiatives. More business owners in these areas can take advantage of microfinance if more people learn about the program’s advantages through targeted outreach initiatives. A more fair distribution of economic opportunities can be achieved through this expansion.

- To determine how microfinance affects entrepreneurs’ income and the longevity of their businesses in the long run, it is essential to set up reliable monitoring and evaluation systems. Post-loan disbursement, MFIs should routinely monitor company performance by collecting data on income levels, repayment patterns, and business growth. This data can guide the development of more efficient microfinance techniques and guide future interventions.

Conclusion

This case study examined the effect of microfinance on the income growth of Afghan entrepreneurs who had taken out loans from microfinance institutions and microfinance banks. After taking out loans from microfinance institutions (MFIs) or microfinance banks (MFBs), 28 business owners—female and male alike—either launched brand-new micro or small enterprises or expanded their current operations. Since microfinance had a beneficial effect on the authors’ income level and caused it to rise substantially, the authors choose to embrace the alternate hypothesis. According to the study, these recipients also saw a significant increase in their savings rate. Thus, the study’s results support the assertions made by MFIs and MFBs, namely, that the financial inclusion of these institutions leads to the creation of jobs and an increase in the incomes of enterprises.

The 28 cases that were available in the AMA and MISFA reports were the only ones used in this investigation. To further understand the economic operations of Afghan entrepreneurs, studies examining the impact of microfinance on large-sample size using primary data are needed.

REFERENCES

- Aden Hassen, T. (2020). IMPACT OF PARTICIPATION IN MICROFINANCE ON INCOME OF RURAL POOR HOUSEHOLDS: THE CASE OF SHINILE DISTRICT OF SITTI ZONE, SOMALI REGION, ETHIOPIA(Doctoral dissertation, Haramaya university).

- Ali, S., &Azimi, M. N. (2018). The role of female entrepreneurs in the economic development of Afghanistan. Journal of Global Business and Technology Readings Book, 7-25.

- Ashraf, D., Rizwan, M. S., &L’Huillier, B. (2022). Environmental, social, and governance integration: The case of microfinance institutions. Accounting & Finance, 62(1), 837-891.

- Balliester Reis, T. (2022). Socio‐economic determinants of financial inclusion: An evaluation with a microdata multidimensional index. Journal of International Development, 34(3), 587-611.

- Bandara, S. J. H. (2023). THE IMPACT OF WOMEN MICROFINANCE IN SOUTH ASIA: A SYSTEMATIC REVIEW OF EVIDENCE. ISSN 2168-0612 FLASH DRIVE ISSN 1941-9589 ONLINE, 121.

- Chandrashekhar, R., &Sultani, A. (2019). Impact of Microfinance on Women Entrepreneur’s in Afghanistan: An Analysis of Selected Cases. Think India Journal, 22(25), 18-32.

- Dhungana, B. R. (2018). Role of Micro-finance on socio-economic development: a study of Western Development Region of Nepal(Doctoral dissertation).

- Dhungana, B. R., Adhikari, B., & Sharma, L. (2022). Assessing the Impact of Microfinance Services on the Economic Transformation of Women in Nepal. The Studies in Regional Development, 54(3), 27-46.

- Iitondoka, J. D. (2018). The effects of micro finance on youth empowerment: A case study of the Namibia Youth Credit Scheme in Otjiwarongo.

- Jabeen, S., Haq, S., Jameel, A., Hussain, A., Asif, M., Hwang, J., & Jabeen, A. (2020). Impacts of rural women’s traditional economic activities on household economy: Changing economic contributions through empowered women in rural Pakistan. Sustainability, 12(7), 2731.

- Laha, A. (2019). Impact of microfinance on poverty in the context of global financial crisis: A cross country analysis in South Asia. In Socio-Economic Development: Concepts, Methodologies, Tools, and Applications(pp. 1317-1333). IGI Global.

- Memon, A., Akram, W., Abbas, G., Chandio, A. A., Adeel, S., & Yasmin, I. (2022). Financial sustainability of microfinance institutions and macroeconomic factors: a case of South Asia. South Asian Journal of Macroeconomics and Public Finance, 11(1), 116-142.

- Moahid, M., &Maharjan, K. L. (2020). Factors affecting farmers’ access to formal and informal credit: Evidence from rural Afghanistan. Sustainability, 12(3), 1268.

- Moahid, M., Khan, G. D., Yoshida, Y., Joshi, N. P., &Maharjan, K. L. (2021). Agricultural credit and extension services: Does their synergy augment farmers’ economic outcomes?. Sustainability, 13(7), 3758.

- Ogbe, S. E., & Kalu, B. O. (2021). EFFECT OF ACCESS TO MICROFINANCE SERVICES ON THE PERFORMANCE OF SMALL-SCALE WOMEN ENTERPRISES IN ABIA STATE, NIGERIA. Journal of Community & Communication Research, 6(2), 187-198.

- Rovidad, M. (2020). Socio-economic Consequences of Microfinance Investment in Pakistan(Doctoral dissertation, Universität Wien).

- Sethi, K., Nasreen, R., & Khan, M. (2019). Performance evaluation of the Microfinance Sector in India and its Neighbouring countries: A Comparative analysis. PRAGATI: Journal of Indian Economy, 6(2), 1-21.

- Singh, D. (2022). Role of Social Entrepreneurship in The Socio-Economic Development of The Developing Countries. resmilitaris, 12(6), 128-143.

- Trokic, A., Barakovac, E., &Efendic, V. (2020). The Socio-Economic Benefits of Microfinance: Conventional Vs. Islamic. Journal of Islamic Monetary Economics and Finance, 6(1), 95-116.

- Ullah, K., Saboor, A., & Ahmad, I. (2020). Effects of Microfinance on Mountain Poverty and Living Standards: An Empirical Investigation from Central Karakorum National Park Region of GilgitBaltistan, Pakistan. NUML International Journal of Business & Management, 15(1), 30-49.

NOTE: The views expressed in this article do not necessarily reflect Pajhwok’s editorial policy.

Visits: 191

GET IN TOUCH

NEWSLETTER

SUGGEST A STORY

PAJHWOK MOBILE APP