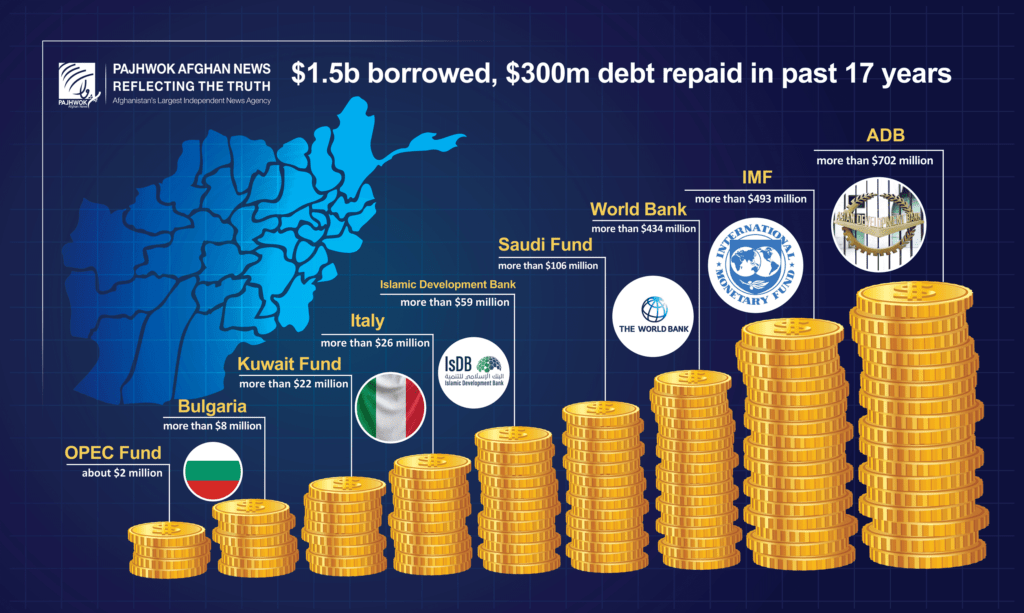

KABUL (Pajhwok): Afghanistan has received $1.5 billion I loans from different international organisations over the past 17 years. During the period, the country repaid only $300 million.

Independent economists warn the country, where the economic situation remains fragile, could be declared bankrupt if it fails to return its debts on schedule.

Figures from the Ministry of Finance, obtained by Pajhwok Afghan News, show Afghanistan demanded $2.7 billion in loans from the World Bank, Islamic Development Bank, Saudi Fund, Asian Development Bank (ADB), International Monetary Fund (IMF), Bulgaria, Italy, Kuwait Fund and OPEC Fund.

Of the $2.7 billion, Afghanistan has received $1.8 billion, with nearly $201,750,000 canceled form donor sources.

From 2003 to 2020, the loans were obtained at interest rates of 0.50, 0.75 and 1.50 percent from the said organisations and the repayment period was between 20 and 40 years.

Since the receipt of the loan, Afghanistan has repaid $256,289,000 in interest. The biggest loan (over $702,460,000) was obtained from the Asian Development Bank and the smallest (over $4.5 million) from the Islamic Development Bank.

According to the document, the government sought these loans for projects, such as the construction of the Doshi-Pul-i-Khumri and the Andkhoi-Aqina roads, as well as the first and second phases of the Kabul Ring Road and some sections of the Kabul-Kandahar highway.

Construction of the Armik-Sabzak-Qala Naw road, the first phase of the Kabul Ring Road, the first phase of a local airport, the Andkhoi-Qaisar road, development of the Herat airport, construction of the Herat-Chist-i-Sharif road and the second phase of the Herat railway line and the second phase of the Khawaf-Herat track were among the projects.

The loans were also intended to cover transport projects, emergency transfers, job creation programmes, business and investment facilitation, emergency power rehabilitation schemes, water supply and construction of schools.

ADB:

The Asian Development Bank (ADB) had promised $747,727,000 for post-conflict multidimensional programs, including the Asian development program in agriculture, Afghanistan Investment Guarantee Facilities, and the reconstruction of the first phase of the regional airport, Andkhoy-Qaisar road, general reforms and financial management, water management in western zone, north-south highway and power supply.

Of the certain amount, ADB has provided $702,460,000 to Afghanistan and it canceled $45,267,000.

World Bank:

The World Bank pledged $443 million in sections of emergency transport sector, reconstruction projects, emergency national job creation projects, and access to remote areas, emergency communication development, modernization of customs emergency and trade facilitation, implementation of emergency power generation project, support for the infrastructure program, Kabul city reconstruction project and the Afghanistan investment guarantee.

Of the pledged fund, WB has provided $434,470,000 to Afghanistan and it cancelled more than $8,615,000.

Saudi Fund:

The Saudi Fund promised Afghanistan $218,700,000 for the construction of the Kabul-Kandahar road, the Armalik-Sabzak-Qala-i-Naw road, the first phase of the Kabul Ring Road and the construction of schools.

Of the loan pledged, the Saudi Fund has provided Afghanistan nearly $106,650,000. An amount of $107,134,000 remains unpaid and $4,900,000 has been scrapped.

Islamic Development Bank:

The IDB pledged more than $140,600,000 for the construction of the Doshi-i-Pul-i-Khumri and Aqina=Andkhoid roads, a power project, irrigation and water resource management and the Kabul Ring Road.

The IDB has so far provided more than $59,470,000 to Afghanistan, with $76,590,000 yet to be paid and $4,540,000 scrapped.

International Monetary Fund:

The international Monetary Fund (IMF) pledged more than $845,193,000 for poverty reduction, extended credit facilities program, quick relief and extended relief.

Of the amount, IMF has provided more than $492,768,000 to Afghanistan, but cancelled $95,976,000.

Afghanistan has received the remaining loans from Bulgaria, Italy, Kuwait Fund and OPEC Fund.

Economic analysts:

Economists say borrowing from international institutions for agricultural development, water control, energy supply, mining and other programs is not a problem, but the government should have comprehensive programs to repay the borrowed money.

SaifuddinSaihoon, who teaches economics at Kabul University, told Pajhwok that it was commendable that Afghanistan had borrowed from reputable international sources for agriculture development, water management, energy supply, mining and other similar projects.

He added that the Afghan government should have a comprehensive and systematic program to repay the loans on time.

He called borrowing an economic principle and said that no country could function without borrowing.

He said aking loans from a credible international foundation at low markup was not a problem and should be consumed for public benefits.

He added taking loan was not a problem, but main problem was poor management and lack of resources.

Referring to problems in the utilization of foreign aid in Afghanistan, he said unfortunately the assistance of the international community was not used on implementation of infrastructure projects.

Saihoon said most of the assisted fund had been spent on aid coordination and management, travel by foreigners and management of water resources.

He said some of the aid, earmarked for the provision of equipment, had been repatriated because the equipment was too expensive to buy and transport abroad.

According to economic analysts, the international community has provided $150 billion in grants to Afghanistan over the past 20 years.

Research by the World Bank and independent foundations shows 80 percent of all international aid to Afghanistan has returned to the donor country.

“Afghanistan has been very irresponsible in organizing projects and spending the assistance of the international community,” he said.

He called on the Afghan government to invest more in infrastructure development projects and have a systematic accounting system to satisfy international and domestic observers.

At the same time, Qais Mohammadi, a lecturer at a private university in Kabul and a political analyst, said that obtaining loans for infrastructure projects that generate income in future was a necessity.

He said it was important to spend money on a specific project to achieve the desired goals.

Mohammadi said the Ministry of Finance should set up a mechanism to repay the loans, adding that the loans should be taken for projects that were beneficial in order to repay them in future.

According to him, if the project does not generate revenue, the government should deposit a certain amount of money in the annual budget to invest in banks to repay the loans.

He stressed that Afghanistan must repay its loans on time, otherwise it would be included in the list of poor countries. “This is a very important and dangerous issue because if Afghanistan is included in this list, no country or international organization will be willing to lend.” he added.

He called the current situation of Afghanistan to borrow money as inappropriate, saying: “Economically, Afghanistan has the potential to generate enough domestic revenue. Not only it does not need to borrow money, but the government can also easily repay previous loans and make a difference in people’s lives.”

He said there would be no need to borrow if peace came as single central government could generate revenue through industry, mining, exports and through other fields.

He stressed the need for peace in the country, saying if the war continued and peace not achieved, Afghanistan would not be able to repay the loans it had received and would not be able to stop borrowing.

Referring to international aid, he said the international community had provided large amounts of money to Afghanistan, but due to a lack of management, most of it had been transferred back to the United States and Europe through security, construction and other companies.

“Afghanistan would not be where it is now if the money was not disbursed,” he said, adding that the lack of management did not mean that loans could not be obtained.

Farid Nawkht, information officer at the MoF, told Pajhwok that it had borrowed $1.5 billion in addition to the grants from the international community in last two decades, in order to implement key projects that were seriously needed.

On debt repayment, he said there was a systematic plan for debt repayment so that Afghanistan would not be included in the bankrupt list.

Without elaborating, he said that the Afghan government was considering a certain amount of money each year for the repayment of debts in the 23rd Code, which deals with the repayment of debts.

In response to concerns economists raise that loans had not been taken to implement profitable projects, he said a certain amount of debt also depended on the previous government and he could not comment about that.

He said loans were taken for projects that were a priority for the nation and government and could not be financed through donors and the country’s internal revenue.

He said for implementation of such projects, the government was forced to take loan.

He called repayment of loans as easy, adding that some loans had no interest rates while others had low interest rates.

sa/ma

GET IN TOUCH

NEWSLETTER

SUGGEST A STORY

PAJHWOK MOBILE APP