GARDEZ (Pajhwok): Pajhwok findings show revenue from 6,500 shops and markets in two districts of south-eastern Paktia province ends up in private pockets instead of going to the government’s treasures.

This investigative report has been prepared by a Pajhwok Afghan News reporter with the help of two technical colleagues.

Documents, evidence and some overt and covert statements of a number of people and officials show that all areas of tax have been neglected or little revenue is collected from them based on secret deals.

The evidence shows revenue officers make deals with shop owners and do not collect taxes and instead accept some money from them as bribe for their personal use.

Paktia revenue officials not only avoid registering new shops, companies, healthcare centers, higher and semi-higher education institutes, private schools, property dealers, showrooms and other tax sources, but even prevent their registration with the revenue office.

Untaxed shops and commercial companies:

Pajhwok findings show that tax is not collected or very little tax is collected from around 3,000 shops in Gardez, the provincial capital.

The rent of a shop starts from 4,000 afghanis a month and reach up to 60,000 afghanis, depending on their location in Gardez city.

According to the tax law, every shop owner should pay the amount of one month rent of his shop as tax annually.

If 3,000 afghanis is the average rent of a shop in Gardez, the total amount collected as annual tax from these shops would reach 96 million afghanis.

There are also 210 markets in Gardez city and each market tax amount is 50,000 afs to 280,000 afghanis.

The average annual tax of each market amounts to 165,000 afghanis and total amount of annual tax of all markets reach 34,650,000 afghanis.

In Samkani district, around 2,000 shops whose monthly rent start from 3,000 to 30,000 afghanis also do not pay their taxes. The average rent of these shops amount to 16,500 afghanis and their annual tax would amount to 33 million afghanis.

There are also 30 markets in Samkani district, whose annual taxes start from 30,000afs to 200,000afs. The average annual tax of each market amounts to 115,000afs while their total annual tax reaches 3,450,000afs, but none pay their taxes.

In the meantime, 1,500 shops in Zurmat district also do not pay taxes. The rent of shops in Zurmat district starts from 2,000afs to 20,000afs. Their average monthly rent amounts to 11,000afs and the total annual tax of all of the shops reach 16.5 million afghanis.

There are also eight markets in Zurmat district, whose annual tax starts from 10,000afs to 50,000afs, but none pay their dues. The average annual tax of these markets amount to 30,000afs and the total annual tax of the eight markets amount to 240,000afs.

Accurate numbers of shops and markets based on survey:

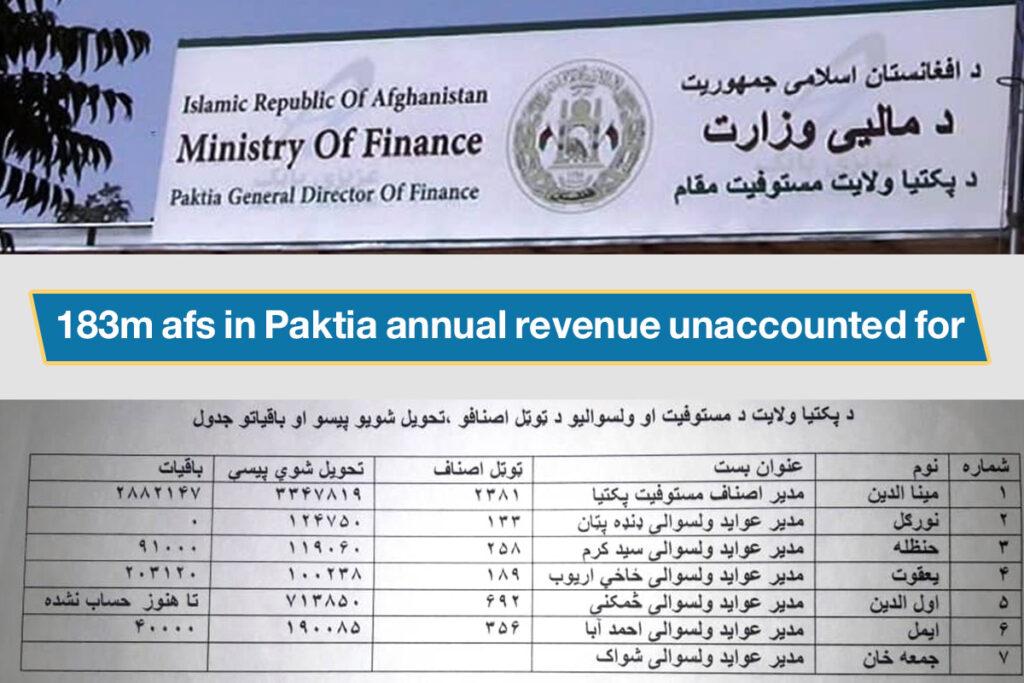

Paktia revenue department collects tax from 2,381 business places in Gardez city while there are more than 8,500 shops and commercial markets there.

Gardiz municipality officials say there are more than 5,000 shops and markets in the city.

Esmatullah Khalid, Gardez mayor said, “We collect taxes on business licenses from around 5,000 shops, this number is not final and we try to register all shops.”

Taxes are also not collected from shops from Samkani and Zurmat districts since last 10 years.

Zaitongul Mangal, Samkani district chief, said, “Samkani is a populated and commercial district, there are around 2,000 shops in its center and municipality normally collects taxes from them, we want the revenue department should also collect taxes from these shops.”

Dawlat Khan Zadran, Zurmat district chief, also said that there were around 1,500 shops and other business places in the district’s center and he asked for collection of taxes from all of them.

These shops give their taxes for urban services, but their taxes are not collected due to lack of personnel there, he said.

There are also a limited number of shops in Gardi Serai, Waza Zadran, Mirzaka, Ahmadkhel, Laja wa Mangal and Janikhel districts, but their taxes are also not collected.

Violation of law by people or weakness of revenue offices and corruption:

Shopkeepers in Gardez city complain about mismanagement in collection of taxes and say they are unsure if their money goes to the national treasure.

Alijan, a shopkeeper in Gardez city, complained of corruption and said that most people did not pay their taxes because most of their money ended up in personal pockets of corrupt officials.

“Corruption is at high level, I do not think even half of the money collected as tax would go to the government’s exchequer, most of the money goes to private pockets,” he added.

Azizullah, a jeweler in Gardez city, said that revenue officers charged less tax on him because they took jewelry from his shop.

“Some officers come and choose a thing from the cabinet, we could not say anything to them because we fear they will charge high tax,” he said..jpg)

Noorullah, another shopkeeper, said he did not pay formal taxes but gave money to revenue officers without passing any documents.

Salim, not a real name, who is a doctor, told Pajhwok that hundreds of thousands of afghanis tax was not collected from a single market due to personal deals.

He said he paid his tax based on his report to revenue department in which he claims examining only one patient a day while he actually checks at least 25 patients a day. He said he like most other doctors paid bribe to revenue officers to charge him less.

Salim said that some doctors examined up to 50 patients a day but they reported checking only one patient.

Haji Dawlat Khan, who runs a cosmetics shop, said that revenue officers took bribes from shop owners in return for charging little tax.

Gul Wali, who sells mobile phone sets, said that revenue officers collected high amount of money from him but they mentioned a small amount in the tax book.

Many other shopkeepers held similar views and said they did not pay tax but revenue officers just take some money from them as bribe.

Meanwhile, Dr. Obaidullah Mukhlis, owner of a market in Gardez, said that one month rent of the market should be paid as annual tax to the government, but they did not do so.

Many people want to pay their taxes based on their national and Islamic responsibilities, but they are unsure if their money will go to national treasure and wait for reforms, he said.

“There are 100 shops in this market, despite the monthly rent of some of them is 8,000afs and their average becomes 4,000afs, if full tax is collected from them, it would amount to 400,000afs, but very little tax is collected due to secret commissions,” he said.

Jamaluddin Asifkhel, a civil society activist in Gardez city, said, “We have seen several scenes in which revenue officers come to a shop or market and tell them that their payable tax amounts to 100,000afs, but it can be lessened if the shop owner paid them 50,000 or 20,000afs as bribe.”

Revenue and relevant organs’ officials acknowledge problems in tax collection:

Elaha, not a real name, a worker of Paktia revenue department, told Pajhwok that a certain group in the department not only did not register revenue sources, but intentionally opposed the practice.

The source said that the revenue department currently lacked 27 personnel including revenue director, revenue manager and treasures manager since last three years.

Another worker of the department, who also wished to go unnamed, said that there were large number of revenue sources in Gardez city, including shops, companies, healthcare centers, higher and semi-higher education institutes, private schools, property dealers, showrooms and others which were intentionally not registered and they did not pay their taxes.

The source said that their revenue declined in the past two years. Citing an example, he said that the department was given a target of 800 million afghanis for annual revenue, but it was not achieved as 650 million afghanis were collected this year.

On the other hand, acting Paktia revenue director Saleh Mohammad refused to comment about bribes being taken by revenue officers but said his office was not convinced from the ongoing situation.

Paktia governor Halim Fidai acknowledged problems in the revenue area and said that no corruption or negligence was acceptable in revenue collection.

He said he had shared the issue of vacant positions in the revenue department and some other problems with the Ministry of Finance and hoped practical steps would be taken in this regard.

This report has been produced by Pajhwok and financially supported by UNDP and Denmark.

mds/ma

Visits: 49

GET IN TOUCH

NEWSLETTER

SUGGEST A STORY

PAJHWOK MOBILE APP